To run a successful business, you have to always keep your employees happy. As an employer, offering a host of employee benefits might help in maximizing the productivity of the company. It is a well-known fact that healthier employees are less likely to fall sick and take leaves. It is very important for an employer to implement a workplace health program to reduce absenteeism among employees.

For any company, excessive employee leaves can equate to reduced productivity. To cover the absence of sick employees, companies incur potential costs for training replacement employees. A group health insurance program is an effective plan which provides medical coverage to all the employees of a company. As an employer, it is imperative to protect the welfare of the employees who are the greatest asset of your organization.

A comprehensive employee healthcare plan helps you retain the best talent in the organization. In today’s competitive corporate environment, safeguarding the health of employees is a matter of utmost importance. Not all employees have health insurance to cover their cost of medical treatment.

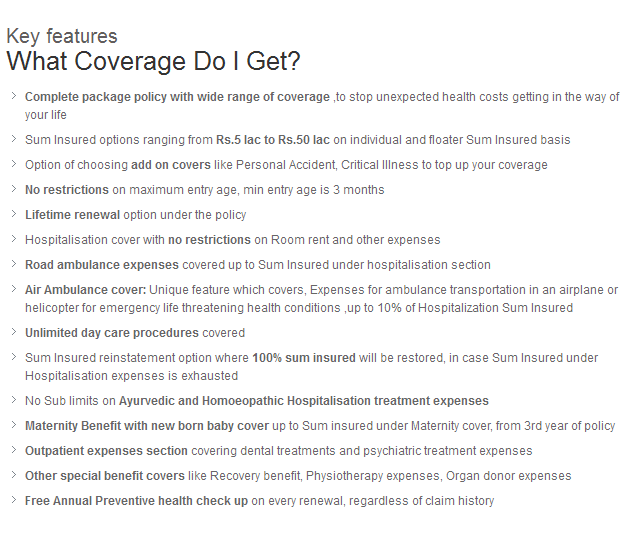

Group Medical Coverage (GMC) lets you protect the health of your employees and maintain a healthier atmosphere in the office. Group medical plan is cheaper than individual healthcare plans. Insurance companies charge lower premiums for a group health plan as the risk is spread out among the group of employees.

For the betterment of the employees, all employers should opt for group medical coverage. Group healthcare policy is uniform in nature as it provides the same set of benefits to all the employees. The participants of the plan have to pay a lesser premium for a host of medical benefits.

While some companies bear the total cost of the group medical policy, most organizations ask the employees to pay their individual premium on a pre-tax basis. Although the health insurance premium has to be paid through payroll deduction by the employee, the money is not taxable.

Group Medical Coverage is gaining popularity since more and more employers are becoming aware of the benefits.

Given below are some of the advantages of a group health cover:

- Affordable:

GMC provides coverage to a large number of people under one group. The amount of sum insured is uniformly distributed among the employees regardless of the health risk factors. Each member of the group is therefore entitled to all the healthcare benefits for a small premium. Employers do not incur a huge cost for maintaining a group medical plan as the premium is shared by all the policyholders.

Under Group Mediclaim (GMC) policy, since a group discount is allowed based on the group size, the share of premium per employee comes much cheaper than if purchased individually.

- Coverage for inpatient hospitalization care:

​ In case, if one of the employees falls severely ill and is admitted to the hospital then the entire medical expenses are covered by the group health plan. Since a large sum of money is insured under GMC, there are no limitations on the cost of medical treatment.

Due to any disease requiring hospitalisation whether under emergency or planned, an employee covered under GMC can avail the benefits of hospitalisation expenses upto the Sum Insured limit.

- Pre-​hospitalization and post-hospitalization care:

​It reimburses the cost of hospital stay and other medical amenities provided by the healthcare center.

For any disease requiring hospital treatment, there must be certain pre-hospitalisation expenses such as Doctors’ consultation fees, medicines, pathological tests etc and similarly, post-hospitalisation too, one need to incur expenses on medicines, pathological test to get confirmed what is the treatment response of the body etc and normally, these expenses are covered, upto the overall limit of Sum Insured, for 30 days Pre-hospitalisation and 60 days Post-hospitalisation.

- Reimbursement of out-patient expenses:

​ Some group medical insurance plans for an additional premium cover the cost of ophthalmological, ENT and dental treatment. Pacemaker placement, chemotherapy and dialysis are some of the other out-patient procedures that are covered under the GMC plan. On the other hand, the premium charges for such additional benefits would be comparatively higher if a member opts for an individual or family healthcare policy.

- Coverage for diagnostic procedures and medications (Covered underPre & Post Hospitalisation):

​Some employees pay extra premium to the insurance company to cover the cost of diagnostic tests like X-ray, CT scan, MRI and blood test. Even the consultation fees of the doctor for diagnosis purposes are reimbursed by the insurer. As an additional benefit, the cost of prescription drugs is also reimbursed by the employee healthcare plan.

- Maternity care and infant health coverage:

Maternity coverage is a special benefit, associated with GMC, given to the female employees in a company. It meets all the medical expenses related to pregnancy and delivery. The coverage includes both inpatient and outpatient services. Female employees who have opted for a maternity healthcare plan have to pay an additional premium to avail adequate prenatal and post-delivery medical care. Aside maternity care, GMC provides all the required medical benefits to the newborn.

As an Add-on benefit, GMC covers Maternity Benefit and new born child benefit too which covers expenses related to child birth in hospitalisation upto the specified limit of the policy.

- Pre-existing disorder coverage:

Unlike individual medical insurance plans, the past health records of the employees are not viewed by the GMC provider. The pre-existing conditions of the employees are therefore covered by the group healthcare program irrespective of their medical history.

Under Individual & Family Mediclaim Policies, pre-existing diseases are covered after four yearly renewals i.e. from the fifth renewed year & onwards. While in GMC, with payment of additional Premium, PED can be covered from day one which is very a relieving factor.

- Family Floater Cover:

​Insured employees can include their family members in the policy by paying extra premium. Without a group healthcare coverage, employers will be unable to help their employees face unforeseen health mishap. Better healthcare facilities for the employees ensure a healthier workplace which reflects on the profitability of the company.

It is a relatively new development in GMC where each family unit of employee, his/her spouse, two dependent children upto 23 years old and dependent parents / parents-in-law can be covered under Family Floater concept where a single Sum Insured will be available for the entire Family Unit ina Policy Year. It is much cheaper as compared to each member of the Family having an independent Sum Insured under GMC.

- GROUP PERSONAL ACCIDENT (GPA):

​For any enlightened Corporate entity, as an effective HR initiative, Group Personal Accident( GPA) Insurance plays as important role as that of GMC. For a very nominal premium, it covers 1] Accidental Death 2] Permanent Total Disability 3] Permanent Partial Disability and dismemberment & 4]Temporary Total Disability. It also covers medical expenses connected with such accident on paying little extra premium.

GPA is a 24 hours worldwide coverage policy. But, employers can go for a restricted cover by paying much reduced premium to go for an “On Duty” cover only which covers only accidents occuring at the workplace and during working hours.

For any enlightened Corporate entity, Group Personal Accident (GPA) insurance scheme is as important as Group Medical coverage.

GPA insurance policy in the event of a severe accident covers:

- Accidental loss of life

- Temporary and permanent disability

- Dismemberment

- Accidental medical costs

As a value-added benefit, GPA policy reimburses the cost of carrying mortal remains in case the death occurs outside the residence of the insured.( GPA program normally provides these benefits when the employees are on duty.

However, as an additional benefit some employees can opt for the off-duty cover which will allow them to avail the post-accident medical facilities during non-duty hours.) GPA insurance policy is a separate entity and does not come under GMC. Hence, employers should purchase it separately to ensure the safety of their employees while they working.

Group health insurance plans are generally provided by many insurance companies. However, as an employer you might have less time going through each policy cover in order to know the benefits, additional coverages, limitations and exclusions. GreenLife Insurance Broking Limited (GIBL) helps you save time and some money on your corporate health insurance program and group personal accident plan.

You can calculate the group health insurance premium to get an optimum rate. Only renowned insurance companies have collaborated with GIBL to provide enterprising employers like you with the best group healthcare plan. Just compare the features and quotes provided by different insurers and choose a plan which offers lower premium rates. Visit gibl.in and choose the best deal for your employees.