Telematics car insurance has finally arrived in India. This innovative model of motor insurance keeps track of driving behaviours and mileage to work out premium by using telematics devices. These devices are either installed in vehicles externally or they come as a built-in feature and they monitor the behaviour of the driver in real time directly. This type of personalized insurance model is also known as usage-based insurance and it operations are based on the multitude of data that telematics garners.

How Do The Telematics Devices Work?

Telematics devices keep records of a myriad of driving behaviours and send out the data to the car insurance company in India so that they can assess the risk and determine the car insurance premium accordingly. For example, a driver who drives mostly at night will have to pay higher premium than a driver who drives mostly during the daytime when the chance of accident is less. Similarly, those who drive their cars at a moderate speed are eligible for lower premium as they are less prone to accident and hence possess less risk to their insurers. Here is a list of information that telematics devices can derive;

- Number of miles driven

- Time of day of driving

- Location of driving

- Instances of rapid acceleration

- Instances of hard cornering

- Instances of hard braking

- Deployment of air bag

However, all of the above-mentioned data are not available through all types of telematics devices. The extent of accumulated data depends on the kind of telematics technology used and also on the willingness of the vehicle-owner when it comes to sharing personal data.

How Telematics Car Insurance is Different from Traditional Model of Car Insurance?

First of all, the telematics car insurance has revolutionized the way car insurance premium is determined. Traditionally, car insurance premium depends on vehicle type, claim history and also on personal details of the driver such as age, gender, and marital status etc. With the introduction of telematics car insurance, the driving habits of vehicle-owners has also come into play along with other parameters that has conventionally used to estimate car insurance premium.

Aside from revolutionizing the the way of working out car insurance premium, telematics car insurance has also opened up a new avenue of availing discount on car insurance premium. Traditionally, policyholders are entitled to discounted premium for incorporating anti-theft devices and also for being member of particular associations and also for their age and profession. With the advent of telematics car insurance, policyholders are also eligible for discount on car insurance premium.

Another major change that have taken place in the niche of car insurance in India with the advent of telematics car insurance is in the mindset of car insurance policyholders. For ages, car insurance premium is perceived as a fixed cost that has to be paid on annual basis. Telematics car insurance has converted it into a variable cost by leveraging on the data on current driving behaviours of individual vehicle owners, rather than depending on mass statistics and driving records that are based on historical trends and events. Keeping individual driving record has helped make premium pricing more personalized, precise and more accurate.

Telematics Car Insurance in India

Bajaj Allianz has introduced telematics car insurance model for the first time in India. The name of the brand new ground-breaking service is called the Drive Smart and by using this service customized car insurance cover have made appearance in India that offer discount on premium on the basis of driving patterns of individuals.

How Much Does It Cost?

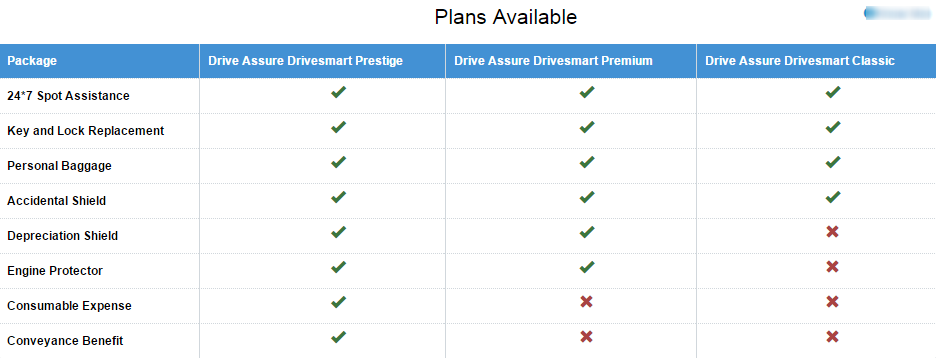

For smaller hatchbacks, Drive Smart service costs around Rs 1,500-2,500 on top of the payable premium each year. For bigger vehicles, the cost depends on IDV of the car. This service is available for owners of private vehicles that buy add-on covers with the basic car insurance. Here is the break-up of all available variants of Drive Smart plan.

Source: https://www.bajajallianz.com/

Drive Smart service monitors the average speed and speed variations of the vehicle, vehicle-owners' brake usage and driving at night. Vehicle owners also can keep a track of the data through a mobile app, users too can monitor this data, and they can also use The app can also be utilized for monitoring the vehicle movement from a remote location.

The insurer uses all the accumulated data on car insurance policy renewal to ascertain whether the policyholder is a safe driver or not. If a vehicle-owners driving habits prove to be safe, he is entitled to get discounts on car insurance premium. However, the discount is applicable only on the 'own-damage' premium of the car insurance policy.

For the first 3 years, the Drive Smart service is offered free of cost. The telematics device installed in the car, however, remains a property of the insurer.

Benefits of Using Telematics Car Insurance

Telematics car insurance offer many advantages to both insurers and the insured. It allows insurers to come up with accurate premiums which justifies individuals' driving habits. This will increase affordability of low-income drivers who are mostly for low-risk drivers. Insured people, on the other hand, gets the chance to manage their spendings on car insurance premium. Vehicle owners who are consider as riskier for insurers will be incentivized to follow safer driving habits and thus reducing chance of accidents and their overall risk to their respective insurers.

Telematics car insurance will also help insurers estimate accident damages accurately. Insurers can also identify fraudulent claims easily by analyzing the driving data. Telematics car insurance offer a host of other benefits as well regarding the safety of the vehicle. In case of theft of vehicle, telematics devices can be used to track and locate the vehicle. In the event of a massive accident, telematics car insurance can improve on the response time as well.

Challenges in Using Telematics Car Insurance

Even though, telematics car insurance comes with an array of beneficial features, there are certain aspects that needs to be taken care of.

- Data Privacy is at Stake

Vehicle-owners might be reluctant to embrace telematics car insurance due to privacy concerns. Since, the device collects a lot of data pertaining to the vehicle and driving habits of the policyholders, many drivers are wary of going for it. To increase the adaption rate, there should be a limit in the number or extent of the data collected.

-

Telematics Devices can be Erroneous

The driving pattern of the policyholders and their car insurance premium in consequence are determined on the basis of the data garnered by telematics devices. If the device doesn't function right the assessment can be inaccurate.

Conclusion

Advanced technology has gone a long way in simplifying complex financial products like insurance. Telematics car insurance is introduced in line with this trend, t. The model has just seen the light of the day in India but globally telematics has proved to a boon for both the insurer and the insured. If you are a good driver and you deserve your cautious driving habits deserves reward in the form of discounted premium you can go for this model of car insurance. GIBL is the premiere online insurance marketplace in India and is the best platform to procure telematics car insurance online. Visit GIBL today and avail telematics service while purchasing your car insurance online.