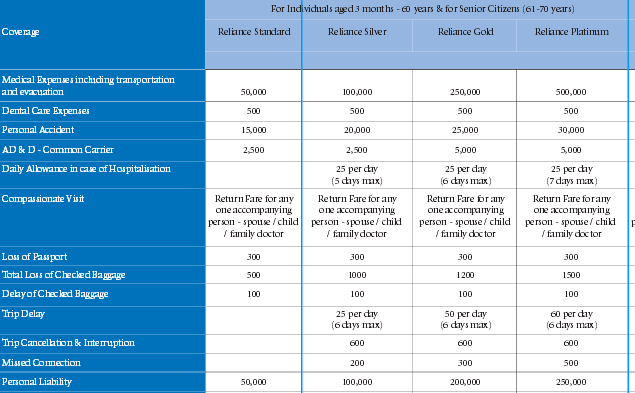

For most of us, this is the best time of the year for holidaying be it within India or abroad. We meticulously pick a holiday destination, book flight and train tickets and reserve accommodations in hotels. But, we seldom realize the importance of having a travel insurance policy that it deserves. Many people, especially the ones who are armed with life or health insurance in India are under the wrong impression that travel insurance only adds to expenses and it signifies nothing. However, this is far from being the truth, a travel insurance plan is quintessential for any traveler regardless of the purpose and duration of travel. Travel insurance in India offers financial protection for a range of unexpected events during a trip. If you fall sick or gets injured in an accident, travel insurance policies take care of your medical expenses. A travel insurance online plan also provides financial compensation in hazardous situations like loss or theft of documents and luggage, trip and flight delay and cancellation. Personal liabilities of insured travelers while traveling within India or abroad are also taken care of by an online travel insurance policy in India. If you are planning a trip in this beautiful time of the year, you should buy travel insurance online to ensure a safe trip. Being armed with a travel insurance, you can handle emergency situations with more confidence and manage your unplanned expenses better. With a plenty of travel insurance policies on offer, you can easily compare travel insurance online and pick the one that covers your holiday destination and suits the purpose of your trip.  Different types of International travel insurance plans To cater to the varying needs of different types of travelers, travel insurance companies in India have come up with several different types of International travel insurance plans. Individual travel insurance plans As the name suggests, this type of overseas travel insurance plans are designed for solo travelers between 3 months and 70 years. this type of travel insurance plan is designed to cover both single trip and multi-trip. Family travel Insurance policies As evident from its name, family travel insurance plans are crafted to cover an entire family during a foreign trips. Most family travel insurance plans in India cover up to 4 family members consisting of 2 adults up to 60 years and 2 children up to 21 years on floater basis. Student Travel Insurance online plans To safeguard Indian students who go abroad for higher studies, many travel insurance companies in India devised this type of travel insurance online policies. To be eligible for a student travel insurance, students have to be in the age-group of 16-40 years and they have to show their enrollment in an overseas institution. Indian students those who are already studying in foreign countries are also eligible for an online student travel insurance available in India. Senior Citizen Travel Insurance plans This type of travel insurance plan is specifically designed to cover elderly people between 61 and 85 years during their trips to overseas countries. Group travel insurance plans Many employers provide their employees with this type of travel insurance online policies in India. A group travel insurance plan offers medical coverage and pays out compensation in various unforeseen circumstances to ensure a safe trip to all the members of the group. Now that you know about different types of travel insurance plans in India, you should be able to figure out which type of travel insurance policy you need. The final task that is left for you is to choose the best travel insurance in India. Best travel insurance companies in India At present, Tata AIG, ICICI Lombard and Bajaj Allianz are top providers of travel insurance in India. The efficiency of a travel insurance company in India depends on the performance of its assistant service provider. Tata AIG boasts their own assistant company which is known as AIG Travel Guard. Bajaj Allianz has their own assistant company as well. ICICI Lombard employs the services of Europ Assistance in the Europe and UHI in the U.S.A which happens to be the biggest service provider .in the U.S. What are domestic travel insurance plans? Traveling within the territories of India is no less enchanting. India is rich in natural and cultural diversities and a trip to any part of the country can well be a rewarding experience. Even though, financial loss of travelers would be lot less while roaming in India if any untoward event takes place, but still it is strongly recommended that travelers avail a domestic travel insurance plan. Is a domestic travel insurance plan necessary? Domestic travel insurance plans available with some of the leading providers of travel insurance in India. These travel insurance online policies play an instrumental role in ensuring a safe and secured tour in any parts in India. If you fall sick or gets injured, your medical expenses will be covered by a domestic travel insurance plan. Domestic travel insurance online policies also cover losses due to trip cancellation or delay, missed departures, loss of baggage and documents while traveling around in India. There is no certainty that you will be in trouble during your trip due to these above-mentioned hazardous situations. A domestic travel insurance plan is necessary anyways to reduce these risk factors and to cope with emergencies efficiently without having to burn a whole in the pocket. . Best domestic travel insurance companies in India An increasing number of travel insurance companies in India are offering domestic travel insurance plans nowadays. Among them, the best providers of domestic travel insurance in India are Bajaj Allianz, TATA AIG, MS Cholamandalam Insurance and Apollo Munich. Here is a brief rundown of the benefits available with the domestic travel insurance plans on offer at these leading providers of domestic travel insurance plans in India.

Different types of International travel insurance plans To cater to the varying needs of different types of travelers, travel insurance companies in India have come up with several different types of International travel insurance plans. Individual travel insurance plans As the name suggests, this type of overseas travel insurance plans are designed for solo travelers between 3 months and 70 years. this type of travel insurance plan is designed to cover both single trip and multi-trip. Family travel Insurance policies As evident from its name, family travel insurance plans are crafted to cover an entire family during a foreign trips. Most family travel insurance plans in India cover up to 4 family members consisting of 2 adults up to 60 years and 2 children up to 21 years on floater basis. Student Travel Insurance online plans To safeguard Indian students who go abroad for higher studies, many travel insurance companies in India devised this type of travel insurance online policies. To be eligible for a student travel insurance, students have to be in the age-group of 16-40 years and they have to show their enrollment in an overseas institution. Indian students those who are already studying in foreign countries are also eligible for an online student travel insurance available in India. Senior Citizen Travel Insurance plans This type of travel insurance plan is specifically designed to cover elderly people between 61 and 85 years during their trips to overseas countries. Group travel insurance plans Many employers provide their employees with this type of travel insurance online policies in India. A group travel insurance plan offers medical coverage and pays out compensation in various unforeseen circumstances to ensure a safe trip to all the members of the group. Now that you know about different types of travel insurance plans in India, you should be able to figure out which type of travel insurance policy you need. The final task that is left for you is to choose the best travel insurance in India. Best travel insurance companies in India At present, Tata AIG, ICICI Lombard and Bajaj Allianz are top providers of travel insurance in India. The efficiency of a travel insurance company in India depends on the performance of its assistant service provider. Tata AIG boasts their own assistant company which is known as AIG Travel Guard. Bajaj Allianz has their own assistant company as well. ICICI Lombard employs the services of Europ Assistance in the Europe and UHI in the U.S.A which happens to be the biggest service provider .in the U.S. What are domestic travel insurance plans? Traveling within the territories of India is no less enchanting. India is rich in natural and cultural diversities and a trip to any part of the country can well be a rewarding experience. Even though, financial loss of travelers would be lot less while roaming in India if any untoward event takes place, but still it is strongly recommended that travelers avail a domestic travel insurance plan. Is a domestic travel insurance plan necessary? Domestic travel insurance plans available with some of the leading providers of travel insurance in India. These travel insurance online policies play an instrumental role in ensuring a safe and secured tour in any parts in India. If you fall sick or gets injured, your medical expenses will be covered by a domestic travel insurance plan. Domestic travel insurance online policies also cover losses due to trip cancellation or delay, missed departures, loss of baggage and documents while traveling around in India. There is no certainty that you will be in trouble during your trip due to these above-mentioned hazardous situations. A domestic travel insurance plan is necessary anyways to reduce these risk factors and to cope with emergencies efficiently without having to burn a whole in the pocket. . Best domestic travel insurance companies in India An increasing number of travel insurance companies in India are offering domestic travel insurance plans nowadays. Among them, the best providers of domestic travel insurance in India are Bajaj Allianz, TATA AIG, MS Cholamandalam Insurance and Apollo Munich. Here is a brief rundown of the benefits available with the domestic travel insurance plans on offer at these leading providers of domestic travel insurance plans in India.

| Travel Insurance Company | Travel Insurance Plan | Benefits of the travel insurance policy |

| Tata AIG | Domestic Travel Guard Policy | Emergency medical coverage except for pre-existing condition. Reimbursement of costs of flight and hotel fare for one family member if the insured person is hospitalized Daily Benefits available during hospitalization Percentage of the sum available in case of injury and or death during trip or while boarding or alighting a flight Reimbursement of costs of transporting dead body of the insured Benefits available for loss of ticket, delay and cancellation of flights, trip delay Percentage of the sum available to cover liabilities in case of property damage |

| Appollo Munich | Easy Domestic Travel Insurance | Personal Accident coverage is available 24 hours and up to the limit of Rs. 500,000 with zero deductible Medical Treatment, Assistance & Evacuation coverage is available in case of accident up to the limit of Rs. 100,000 with zero deductible Trip Cancellation and Curtailment coverage is available up to the limit of Rs. 500,000 with zero deductible Losses due to Flight Delay is covered up to the limit of Rs. 1,000 with zero deductible Coverage available for Baggage Loss up to the limit of Rs. 7500 with zero deductible. The coverage for baggage loss is restricted to 10% per item and 50% Per Baggage. Emergency Travel and hotel expenses are covered up to Rs. 10,000 |

| Bajaj Allianz | Reimbursement of Emergency Accidental Medical expenses up to the limit of Rs. 100,000 with zero deductible Benefits available in case of accidental Death up to the limit of Rs. 300,000 with zero deductible Coverage available for Trip Cancellation up to the limit of Rs. 10,000 with zero deductible Coverage available for Baggage Loss up to the limit of Rs. 7500 with zero deductible. The coverage for baggage loss is restricted to 10% per item and 50% Per Baggage. 24 Hours Assistance available Coverage is availble for a maximum of 30 days foe each trip. | |

| Cholamandalam | Cholamandalam Domestic Travel Insurance | Covers an entire family during a trip within India Coverage available for medical emergencies A percentage of Sum available for permanent disability and death Reimbursement of losses due to lost documents and baggage, travel delays Covers personal liability of the insured traveler Outstation place benefit is available |

Now that you are aware of the importance of availing travel insurance before embarking on a domestic or international trip, you have certainly made your mind to buy travel insurance online. However, to make an informed purchase, you should know what to look for while buying travel insurance online in India. The following are the pointers that you have to pay heed to to ensure that you buy the best travel insurance in India. Points to check when you buy travel insurance online

- You should opt for a higher coverage for medical expenses especially if your destination is either US or Canada to ensure you don't have to pay a penny from your wallet.

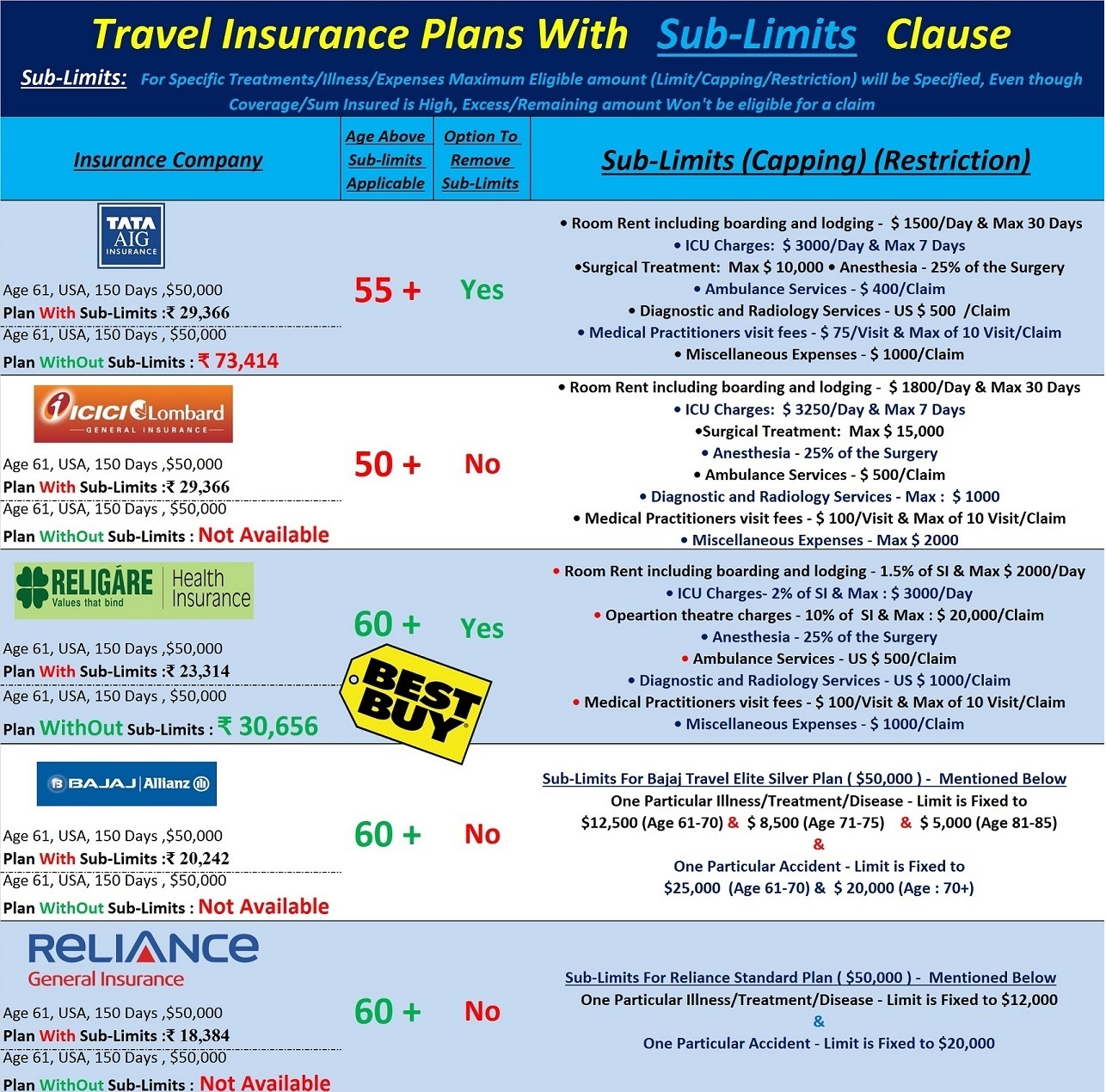

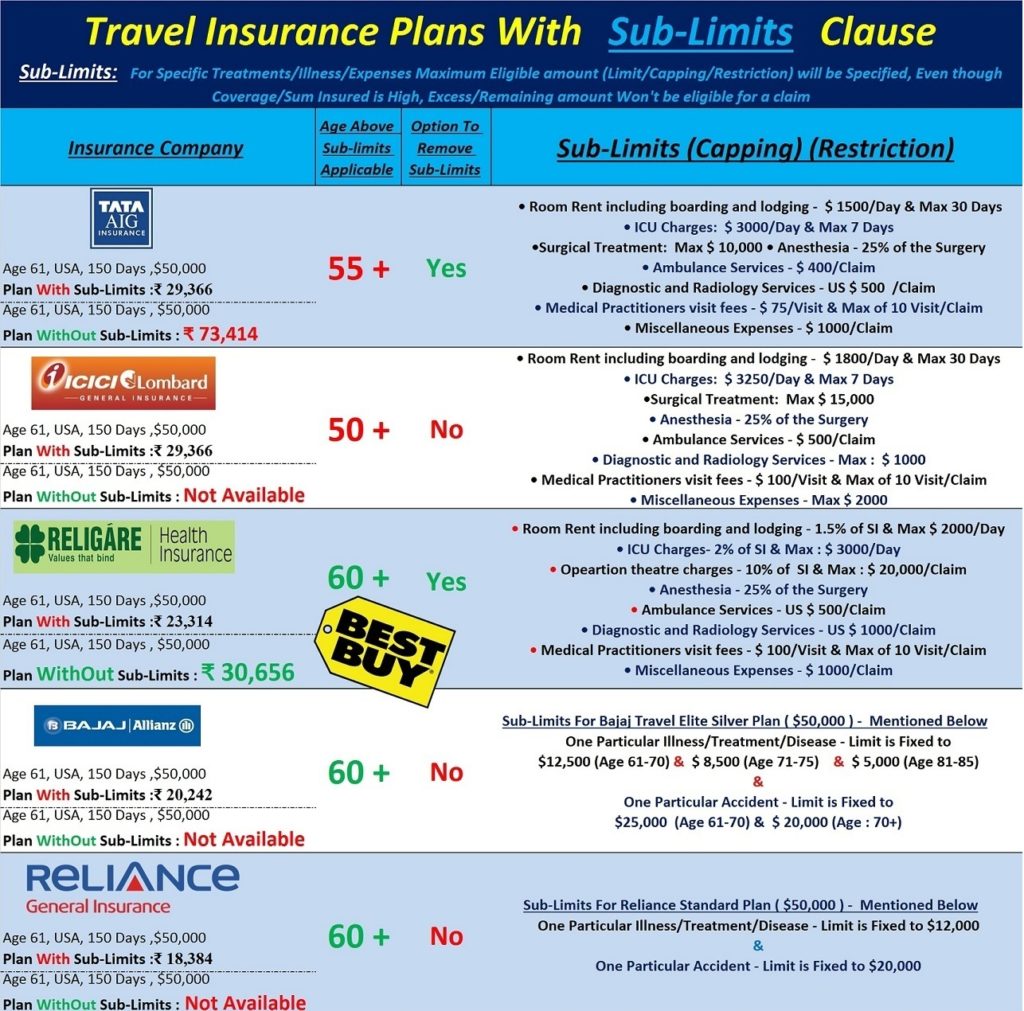

- You need to go through your travel insurance policy document closely and find out if there is any disadvantageous clause like deductible, co-payments and sub-limits. You should steer clear of travel insurance plans with such unfavorable features.

- You should also try and gather information about the credibility of the medical assistance provider of the travel insurance companies. Your chosen travel insurer must work with a reputed company with wide network of healthcare facilities in all the locations you are supposed to visit.

- You shouldn't compare travel insurance online in terms of premium. A low-priced travel insurance online policy might fail to cover our expenses especially in abroad. Therefore, you should focus chiefly on the coverage and the reputation of the insurer and service provider.

By taking these pointers into account, you can keep all worries at bay while traveling and let your travel insurance company take control of adverse situations. This is why, you have to pick the best travel insurance company in India very carefully.

Source: Quora

Why should you check out all the fine prints? As it is mentioned above, the importance of keeping a close eye on travel insurance policy documents cannot be stressed enough. In particular, you should read all the fine prints and understand them thoroughly. The inconvenience usually arises when coverage is not provided for some certain types of losses. Some travel insurance plans in India don't cover losses due to war, political unrest or terrorism so you need to be aware of the list of exclusions as well to avoid any disappointment later. You should also gain clear information on the restrictions imposed prior to covering pre-existing ailments. How to make a claim on your travel insurance policy online? To make a valid claim on your online travel insurance plan, you need to furnish some necessary documents. These documents are essential to initiate the claim settlement process. However, it depends on the type of travel insurance policy that you have availed and you can read through your travel insurance policy document to understand which set of documents you need to divulge in order to file a valid claim on your travel insurance plan. You can also gain the same information from the claim form provided by your travel insurer along with your online travel insurance policy document. A travel insurance claim form usually comes with the comprehensive list of documents that you need to submit and the contact details of all the claim administrator that are supposed to receive, handle and process your claim intimation. It is advisable that you get yourself familiarize with the entire process of registering a claim with your travel insurance company so that you don't have to face any issue at the time of making an actual claim. How to Buy Travel Insurance Online? With the advent of internet, buying insurance has become a child's play. You can now buy insurance online anytime and from anywhere. Even, it is now possible to buy insurance online on the go through mobile apps. All travel insurance companies in India now have a robust online presence. You just have to select the right insurer and visit their portal. On the portal, you have to select the travel insurance plan you want to buy, provide your journey and personal details and make the payment online once you receive the available travel insurance quotes for your chosen policy. The entire process of buying travel insurance online takes just a few minutes. Alternatively, you can resort to a neutral portal that showcases all the available travel insurance plans relevant to your requirements. GIBL, being a leading online insurance broker houses travel insurance plans from all insurers in India. You can compare all available travel insurance plans and buy the best travel insurance in India as peer your needs right from the portal of GIBL. Bon Voyage! You are now all set to embark upon your much-awaited trip. Visit GIBL today to get the best travel insurance plan so that you can keep your worries at bay and enjoy your trip to the fullest. Have a safe and happy trip ahead!