Looking for an adventurous holiday but on a tight budget? Well, travel insurance is there for you. Travel insurance could save you thousands if something goes wrong when you are out of the country or in a foreign land. There are many reasons to consider while buying any travel insurance plan. But sometimes you may think that a travel insurance policy cost you more than a normal health insurance plan. Following are some of the most important points which you have to follow while purchasing any travel insurance and to cut your travel insurance costs.

- An Annual Travel Insurance Plan will Always be a Good Decision

Annual travel insurance plan is a type of travel plan that you keep all year long. If you are the kind of traveler who knows about the travel plan in advance, then purchasing annual travel insurance can save you a lot of money and time over covering individual tours with separate plans. And if you are a regular traveler - possibly for business or for educational reasons, having an annual travel insurance policy means you will get the coverage against medical exigency, emergency evacuations, and travel delays and many more.

- You should Shop around for Travel Insurance Quotes

If you are looking for the cheapest priced travel insurance plan, then you need to get travel insurance quotes from many providers - the best way to find a good deal. The travel insurance cost can vary widely between the insurers; hence it is worth to shop around before choosing a travel policy. However, it is always suggested not to just opt for the cheapest priced travel insurance plan, because it may not protect you fully if you need to make a claim. You should choose a policy that offers all the cover you need at the best price.

- Do Not Buy Travel Insurance from a Travel Agent or Airline

When you book flights or hotels for your holiday then buying a travel insurance coverage is certainly an easy and convenient option. Regrettably, it is also an expensive option. Most of the time we used to buy travel insurance policies from any travel agent or airline due to our busy schedules. However, it is always advised not to purchase travel insurance from any travel agent or airline. Generally, travel agents and airlines add heavy amount of commissions on top of the cost of the policies they sell, which essentially means you end up paying a whole lot more for cover than you need to. According to a survey, purchasing a travel insurance plan through an airline or a travel agent is more expensive than a direct travel insurer. If you buy your insurance policy direct from the travel insurer, you can save a lot more.

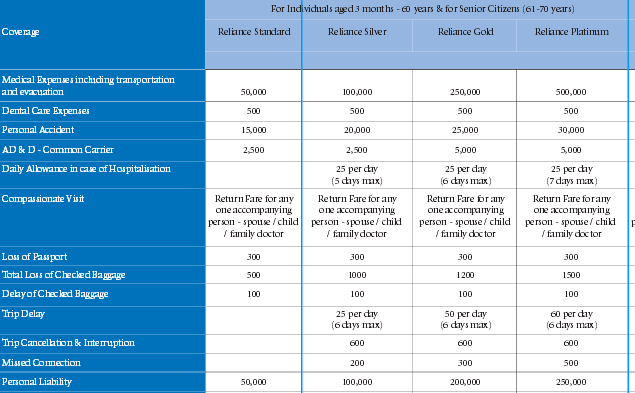

- Always Choose the Policy that Provides Right Coverage

There are various types of travel insurance coverage, but you should choose such type of coverage that you need the most. At first, you ought to decide your requirements and then you have to go ahead for your travel insurance plan. Your budget cost is always a crucial factor while choosing a travel insurance plan. If you choose the plan as per your needs, you can be able to select the budget accordingly.

- Avoid the Unnecessary Options

While purchasing any travel insurance policy, you may come across that the coverage you want is not included as customary. To customize a policy to suit your trip, it may be necessary to add some optional covers like winter sports cover, adventure sports cover, golf cover etc to your policy. Adding these optional coverage always require some additional premium, so make sure they are actually essential for your holiday. By avoiding any needless options, you can substantially lower the cost of cover.

- Keep Following Travel Insurance Discounts

It is needless to pay full price for anything when you can save more money with a discount. Insurance is not an exception in that case. There is always an ample range of travel insurance deals and special offers available. So you should keep an eye out on every travel insurance discounts and check how much they can help you to save.

- Know Your Destination Details

The holiday destination(s) you choose can have a big impact on your travel insurance coverage. Where you go for your holiday can play a big part in determining the level of cover you need. For instance, if you are heading to the United States, a policy that covers limitless overseas medical expenses is essential to help you to pay for the treatment in that country’s expensive health system, but there are some other countries around the globe where you may not need the same high level of cover. So before leaving for any holiday vacation, you need to decide the destination at first and then choose the travel insurance.

- Select a Multi-trip Policy

If you are one of those who travels frequently and takes multiple overseas trips a year, purchasing a separate travel policy for each holiday can be quite expensive. That is why it’s worth considering a multi-trip insurance policy.

Conclusion

If you are on the search of a cheapest priced travel insurance plan you must follow those above mentioned points. These will help you to reduce the cost of travel insurance.