Summer is the most preferred season for vacation among the majority of Indians. Children enjoy prolonged summer vacation in most states and their parents also make efforts to beat the heat by planning a vacation abroad. Solo backpackers also look for respite from the relentless heat simply by holidaying in an International destination. In essence, a foreign trip is very much on the cards during summertime for Indians from all walks of life. In this summer of 2016, if you fancy a trip overseas, you can choose from a plethora of exotic destinations. No matter where you choose to go you should carry a valid travel insurance policy along to remain financially safe from several different unexpected mishaps. Why Should You Avail Travel Insurance Plans? Most foreign countries like US, Australia has made travel insurance essential from only some specific travel insurance companies for visa processing. Being armed with a travel plan you are entitled to make claims for a list of unplanned expenses during the trip. The following risks are covered under a comprehensive travel insurance plan.

- Emergency hospitalization due to illness

- Loss of checked and delayed baggage

- Loss of passport

- Replacement of essential items

- Evacuation from host country on emergency basis

- Accidental injury during the trip

If any of these unforeseen event spoils your trip you can not only get your financial losses reimbursed when you get back to India but you can also get assistance from your travel insurer to fix any issue during your trip abroad. In case, your travel schedule changes and you decide to stay in abroad for longer period of time, you can get the travel insurance policy renewal done online and extend it’s validity. How To Find The Best Travel Insurance Company in India? Now that you know why a travel cover is indispensable for a worry-free vacation, you would obviously look to deal with the best many people make the mistake of choosing travel insurer on the basis of the Sum Insured and premium of the policies on offer. Along with these two crucial parameters you need to consider many vital factors to make an informed choice of travel policy. The following are the criteria to find the provider of best travel insurance plan in India.

- Online services

- 24 hour helpline

- Claims process

- Toll free number

- Network of hospitals

- Payment options

- Terms and conditions

- Exclusions

Comparison is the key to find the best travel insurer. You should always take time to compare best travel insurance plans in terms of the above-mentioned factors. Your decision should not be influenced by any one of these factors; rather all these factors should contribute in making the final decision. Let’s take a look at top travel insurers in 2016. Best Travel Insurance Companies in 2016 As of now, more than 25 travel insurers are operating in India. This huge profusion of providers makes the task of selecting the right insurer even more difficult. But, you need to ensure that your chosen insurer is trustworthy and your hard-earned money is in safe hands. Here is a list of the best travel insurance providers keeping all the important criteria in consideration. ICICI Lombard One of the best aspect of ICICI Lombard travel insurance plan is, ICICI Lombard travel insurance policy allows coverage without medical tests up to 85 years of age. Furthermore, Cashless hospitalization facility is available worldwide under ICICI Lombard travel cover. No wonder, ICICI Lombard won the CNBC Awaaz Travel Awards 2015 and became the “Best Travel Insurance Company”. ICICI Lombard offers three different types of travel policies such as;

- Single Round Trip

- Gold Multi Trip

- Senior Citizen plan

|

Plans |

Single Round Trip |

Gold Multi Trip |

Senior Citizen plan |

|

Eligibility |

Plan available up to 85 years |

Plan available up to 70 years |

Plan available for people between 71-85 years |

|

Key Features |

Original travel policy is valid for 180 days and it can be extended for another 180 days |

Policy can be availed for 30, 45 or 60 days during a year |

Original travel policy is valid for 180 days and it can be extended for another 180 days |

|

Quality health care guaranteed through United Health International |

Quality health care guaranteed through United Health International |

Quality health care guaranteed through United Health International |

|

|

Medical Concierge, Automotive Assistance, Lifetime services for dependents back home |

Medical Concierge, Automotive Assistance, Lifetime services for dependents back home |

Medical Concierge, Automotive Assistance, Lifetime services for dependents back home |

|

|

Trip Cancellation and Interruption |

Trip Cancellation and Interruption |

Trip Cancellation and Interruption |

Source: icicilombard.com

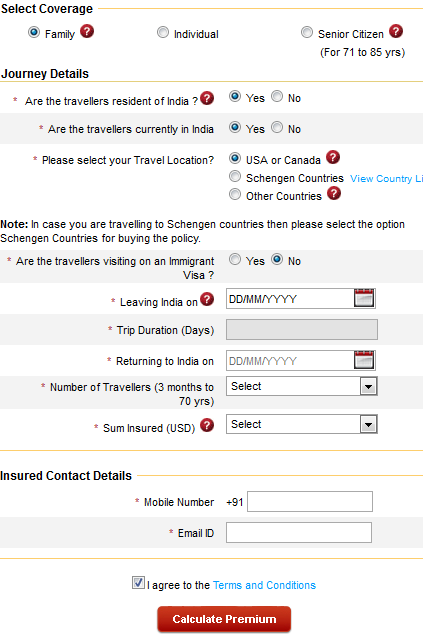

How To Calculate Travel Insurance Premium? First of all, you need to choose the category of travel policy among Individual, Family and Senior Citizen. After choosing the category you need to choose your destination and provide some basic information regarding your trip.

Source: icicilombard.com

TATA AIG The owner of CNBC Awaaz Travel Awards 2012, 2013, Tata AIG is another leading travel insurer in India. The provider offers 4 types of travel policies to cater to the needs of all types of travelers such as;

- Travel Guard

- Student Guard- Overseas Health Insurance Plan

- Asia Travel Guard Policy

- Domestic Travel Guard Policy

|

Plans |

Travel Guard |

Student Guard- Overseas Health Insurance Plan |

Asia Travel Guard Policy |

Domestic Travel Guard Policy |

|

Variants |

Five plans under the Single Trip policies. Two options under Annual Multi Trip Plans. |

5 Plan options – Plan A, Plan B, Ultimate, Ultimate Plus and Supreme |

No Variants available |

No Variants available |

|

Renewability |

Renewable for life (For annual Multi Trip only). |

This policy will be renewed till the age of 35 years |

This policy will be renewed till the age of 35 years |

Renewable for life (For annual Multi Trip only). |

|

Key Features |

Emergency Assistance, Medical Evacuation, Repatriation across the Globe |

Comprehensive coverage for Maternity Benefits, Child Care, Cover for Mental and Nervous Disorders, Cancer Screening and Mammography examinations |

Reimbursement of medical expenses due to accident and sickness. |

Accidental Death and Dismemberment Benefit |

|

15 days Free Look period (For the new business under annual multi trip only) |

15 days Free Look period (For the new business under annual multi trip only) |

Coverage available for Emergency Medical Evacuation and Repatriation of Remains |

Emergency Accident Medical Expenses Reimbursement |

|

|

30 days Grace Period (For renewals annual multi trip only) |

30 days Grace Period (For renewals annual multi trip only) |

Coverage available for Checked Baggage Loss and Delay, Loss of Passport, Personal Liability |

Coverage available for Missed Departure (Rail / Air) |

Source: tataaiginsurance.in

Bajaj Allianz

Bajaj Allianz already bagged the coveted CNBC AWAAZ Travel Awards as the best Travel Insurance Company in 2010, 2011, 2014. Bajaj Allianz enjoys a robust presence in the India’s travel insurance space by virtue of its comprehensive travel policies. Here is a list of travel covers on offer at Bajaj Allianz.

- Individual Travel insurance Plan

- Family Travel insurance Plan

- Senior Citizen Travel Insurance Plan

- Student Travel Insurance

- Corporate travel Insurance

|

Plan |

Individual Travel insurance Plan |

Family Travel insurance Plan |

Senior Citizen Travel Insurance Plan |

Student Travel Insurance |

Corporate travel Insurance |

|

Variants |

Travel Companion, Travel Elite and Travel Prime Plan |

Travel Companion, Travel Elite and Travel Prime Plan |

Travel Companion, Travel Elite 61-70 and Travel Elite 71-75 Plan |

Study Companion Plan, Student Elite Plan and Student Prime Plan |

Companion, Elite, Travel Prime Corporate, Age 61-70 |

|

Key Features |

Covers expenses of hospitalization, loss of baggage and other incidental expenses |

Covers expenses of hospitalization, loss of baggage and other incidental expenses |

Covers expenses of hospitalization, loss of baggage and other incidental expenses |

Covers expenses of hospitalization, loss of baggage, accident to sponsor, family visit and other incidental expenses |

Coverage available for Medical expenses, evacuation and repatriation |

|

Covers you against trip cancellation, trip curtailment and burglary of your home* |

Covers you against trip cancellation, trip curtailment and burglary of your home* |

Covers you against trip cancellation, trip curtailment and burglary of your home* |

Covers you against bail bonds and tuition fee** |

Coverage available Loss and delay of baggage |

|

|

Quick disbursement of claims |

Quick disbursement of claims |

Quick disbursement of claims |

Covers you against loss of passport*** |

Total coverage up to 180 days in a year |

|

|

Only insurance company with in-house international toll-free numbers and fax numbers |

Only insurance company with in-house international toll-free numbers and fax numbers |

Only insurance company with in-house international toll-free numbers and fax numbers |

Covers you for emergency dental pain relief**** |

Daily hospitalization allowance available |

* Available with Travel Elite only

** Available with Student Elite only

*** Available with Brilliant Minds only

**** Available with Study Companion and Student Elite

Source: bajajallianz.com

The Travel Asia Policy

The Travel Asia Policy is another offering by Bajaj Allianz. This is a comprehensive travel cover that offers provide total medical cover to the international traveler. The policy comes in two variants; Travel Companion and Travel Elite. Each of these two variants comes with two sub-variants as well. These sub-variants under both Travel Companion and Travel Elite are known as Asia Flair and Asia Supreme. The below is the coverage of each category of Travel Asia Policy.

Policy Coverage

Source: bajajallianz.com

HDFC ERGO HDFC ERGO has come up with an array of general insurance products that encompass Health, Motor, Travel, Personal Accident and Home in the retail space. The company received iAAA rating by ICRA for paying highest amount of claim. As far as the travel policies are concerned, HDFC ERGO offers Single Trip, Multi-Trip, Asia plan (excluding Japan), Family Floater plan and a Student Travel Insurance Plan called Student Suraksha.

|

Plan |

Single Trip |

Multi-Trip |

Single Trip Asia (excluding Japan) |

Family Floater plan |

Student Suraksha |

|

Eligibility |

6 months to 70 years |

18 years to 70 years |

6 months to 70 years |

Self and Spouse upto 70 years, 2 dependent children from 3 months to 21 years |

16 years to 35 years age |

|

Key Features |

Policy available in 3 easy steps |

Policy available in 3 easy steps |

Policy available in 3 easy steps |

Policy available in 3 easy steps |

Worldwide coverage for a period of 30 days to 2 years |

|

Coverage available for individual and family |

Coverage available for individual and family |

Coverage available for individual and family |

Coverage available for individual and family |

24*7 international travel assistance support |

|

|

24*7 international travel assistance support |

24*7 international travel assistance support |

24*7 international travel assistance support |

24*7 international travel assistance support |

Policy Management online to match policy period with study duration |

|

|

Policy Management online to match policy period with travel dates |

Policy Management online to match policy period with travel dates |

Policy Management online to match policy period with travel dates |

Policy Management online to match policy period with travel dates |

No requirement of health / medical check-up |

Source: hdfcergo.com

Religare

Although, Religare is chiefly known as a leading health insurer in India the insurance company has also made a mark in the niche of travel insurance by offering an array of comprehensive travel covers. The travel policies on offer at Religare are of two types; Explore and Student Explore Plan. The Explore Plan comes in 6 variants such as;

- Explore Asia

- Explore Africa

- Explore Europe

- Explore Canada+

- Explore Gold

|

Plan |

Explore Plan |

Student Explore Plan |

|

Key Features |

No upper age limit. No limit per disease |

Comprehensive & low cost plans for Students |

|

Automatic doubling of sum insured without any extra costs |

Coverage available for Personal accident, travel inconvenience benefits |

|

|

Pre Existing disease & OPD coverage |

Availability of optional covers to customize plan according to University requirements |

|

|

Pay per day rates instead of slabs |

Flexible coverage tenure from 1 month to 3 years |

|

|

Cashless claim settlement available |

Sponsor Protection available |

|

|

Upgrade to business class available |

Cashless claims settlement available |

Source: religaretravelinsurance.com

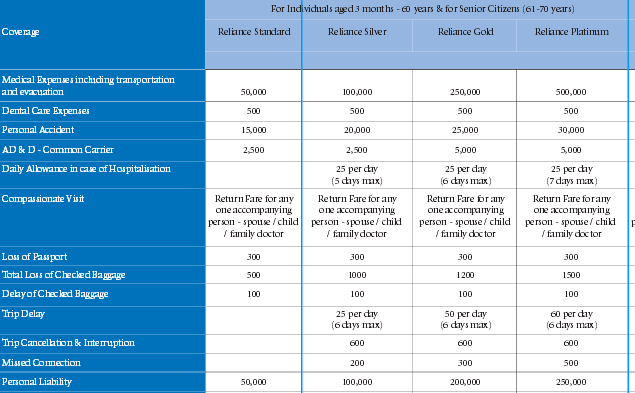

Explore Platinum Aside from the above-mentioned travel policies, Religare offers a plethora of optional covers under Student Explore Plan as well. Here is a complete list of these optional covers and how much they cost in each variant.

Optional Covers

Aside from the above-mentioned travel policies, Religare offers a plethora of optional covers under Student Explore Plan as well. Here is a complete list of these optional covers and how much they cost in each variant.

Source: religaretravelinsurance.com

Conclusion: Finding the right travel insurer is not an effortless job by any stretch of imagination. Your chosen travel insurance provider must have a wide network globally which is capable of providing support promptly. Most importantly, you have to ascertain that your chosen insurer is also the approved insurer of the country you are heading to. To gather more information about these top travel insurance companies and their reputation you should check news and read articles. Once you shortlist a few of them you should also be able to compare travel policies offered by them. Selection of the right travel policy is no less hazardous than selecting the right travel insurer. You need to ascertain a lot of factors before settling on any particular travel cover. You need to choose a travel policy that offers wide coverage that will safeguard you from all possible inconveniences. Before buying any particular plan you should always compare available plans. GIBL.IN, the premiere online insurance marketplace facilitates travelers like you with easy, fast and neutral comparison of all the travel insurance plans available in India. You just have to put in some basic details to get a list of travel policy quotes. You can compare plans in terms of premium and other features and buy the right travel plan right from the portal of GIBL.IN as per your needs and budget.