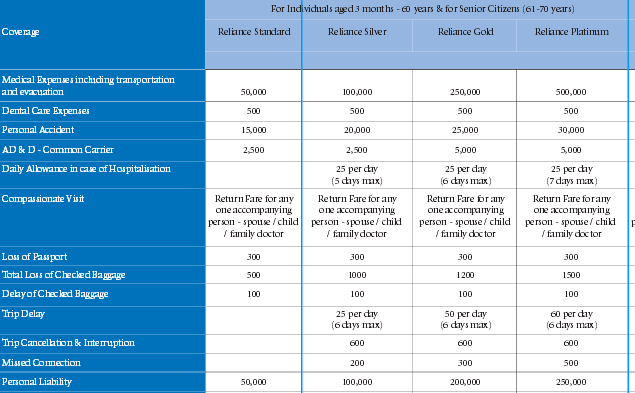

‘Yes, I am a travel enthusiastic and I love to live vacation to vacation.’ If you are so, then you must consider a travel insurance plan. You may wonder how a travel insurance plan would help you in your getaway. Well, a travel insurance policy would help you to tackle all the travel and medical contingencies while you are aboard. But some people think a travel insurance plan is more expensive than any regular insurance plan. So they find buying a travel insurance is a silly approach, but it is always better to be safe than regret in future. Since, travel insurance now becomes a need for every traveler, it is better to find the best travel insurance plan at the best price. According to the survey, the best time to buy a travel insurance policy is at the same time you buy your holiday tickets and book hotel. In that way, you are protected economically not only against the accidents or mishaps while you are away, but also against cancellation costs that may avert you from travelling at all.

Why Should You Purchase Travel Insurance Sooner?

Booking travel insurance policies as soon as possible means, you can be benefitted from the cancellation cover, which is considered as one of the most basic essentials of any travel insurance package. Buying early travel policy can protect you against the cancellation costs. You just need to prove your concerned insurer that you were already covered when something unfortunate has happened. If you can’t provide the valid prove, it could mean your cancellation cover is not valid. Cancellation cover of your travel insurance policy allows you to claim back your prepaid costs if you need to cancel your trip before departing the country. If you purchase a travel insurance policy early, in most of the cases, you can claim for the lost funds pertaining to cancelled, non-refundable flights, accommodation, activities, tours, travel agency fees and other associated travel bookings.

Once you have booked and paid for a trip even just a deposit, you are committed to the outing, and if you are enforced to call off your trips for cause beyond your control, you will be left out of pocket if you still have not yet purchased your travel insurance policy. That is why you ought to purchase your travel insurance plan as soon as possible.

Circumstances of Claim Cancellation Cover

If you have to cancel your trip prior to your leaving, you can easily make a claim for your expenses if your cancellation is due to

- Injury, illness or death of your

- The death, injury or illness of an accompanying person you are travelling with,

- The injury or illness, death of a relative back home,

- A substantial adversity at home such as floods, fire, burglary within 48hr before the date you planned to depart and many more.

Role of a Travel Insurance Plan

Having a travel insurance policy early can cover you if you fall sick closer to your holiday, even with pre-existing conditions, as long as you have declared them. So it is wise to buy a travel insurance policy as soon as possible. An effective travel policy can protect you in all the possible ways. However, while purchasing you should compare travel insurance quotes online and then choose the best one.