COVID-19 affected nations have been issued an advisory against international travel. However, if you still choose to travel in a foreign land, your travel insurance claims could be rejected by the insurer.

The Coronavirus (COVID-19) outbreak all over the world has led to a vigorous surge in cancellations by airline companies following travel restrictions placed on individuals. As a result, travel insurance policies, which would have otherwise covered flight delay or cancellation or hotel stay, could exclude coronavirus-related delays.

When the matter comes down to our country India, the government has ‘strongly advised’ Indian citizens to refrain from travelling to China, Iran, Italy, Japan, Republic of Korea, Spain, France and Germany from March 13. In addition to that, any Indian traveller coming from these locations would be quarantined at arrival for at least 14 days.

Now, this means that any connecting flight from the point of arrival to any other location in India can be taken only after the mandatory 2-week quarantine. Owing to this, trip cancellations or delays could be a standard exclusion under travel insurance plans.

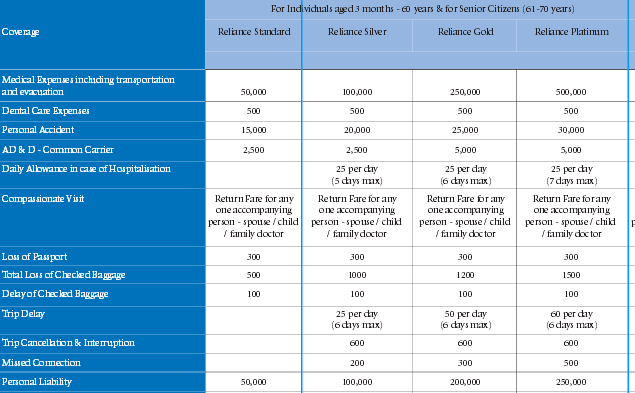

What Will My Travel Insurance Cover?

If you have already purchased a travel insurance policy, the policy terms and conditions will be applicable. But, if you are thinking about purchasing a new travel insurance policy to the countries specifically mentioned above, it could be excluded from coverage.

- However, domestic travel, baggage loss claims, and trip delays within India will continue to be covered under the standard travel insurance policies.

- Same will be applicable for emergency medical expenses during the travel.

- Any unforeseen health expenses incurred owing to coronavirus or other health ailments will be covered.

“Since the government has advised against international travel, Indians still risking travel to COVID-19 nations in Asia, Europe and US will have to bear additional costs. Travel insurance may not be able to come to their rescue,” said the head of distribution at a mid-size private general insurance company in India.

It’s not India only; all over the world as well insurers have either stopped providing travel insurance for the time-being or have particularly stated that any disruption caused owing to COVID-19 will not be covered under a travel plan.

AXA UK stated on its website that if you purchase a new travel insurance policy now, it will not cover any trip cancellation or disruption in relation to COVID-19.

The insurance company also stated that if you already have an annual multi-trip policy and you book a new trip now, you may not be covered in the event of trip cancellation, or for any disturbance that you may experience. The coronavirus exclusion is only applicable to disruption or trip cancellation claims.

However, medical costs that are attributable to emergency expenses will continue to be under coverage. AXA UK said it will continue to cover medical costs if customers become ill in a country or region that individuals have not been advised against visiting.

How to Check What Is Covered?

It is necessary to buy travel insurance if you travel an international destination or abroad, especially during the coronavirus outbreak.

- It is advisable to the potential customer to check the list of exclusions in the policy terms and conditions.

- If you find COVID-19 is mentioned in the exclusion list, there is no point of buying a travel insurance policy from that insurer since all your trip delay-related claims will be rejected.

It’s important to note that travel insurance companies may not always mention the words ‘coronavirus’ or ‘COVID-19’. Even words like epidemic or pandemic, infectious disease in the list of exclusions would mean that trip cancellations or delays as a result of coronavirus (COVID-19) outbreak will not be covered.

Prior to the coronavirus outbreak, almost all the insurance companies did cover trip delays and cancellations due to infectious disease.

You must also consider the fact that there could also be cases where the insurance company would have taken a decision to keep out certain countries from the coverage, but have not yet updated the terms and conditions on their official website. In this scenario, the best way would be to call up the customer care service desk of the company and get clarity on the updated exclusions list before purchasing a travel insurance policy.

During a pandemic outbreak like COVID-19, an advisory by a government in a particular country is as good as a mandate or ban. Even if you are not banned from travelling and choose to go for a leisure trip to an affected country, the cover could be automatically declared ‘void’ since you did not comply with the official instructions.

This is because insurance works on the concept of probability of risk. When there is a certainty that an individual is exposing themselves to potential risk by travel, he or she will not be provided insurance cover.

So the best decision you can take right now is to avoid any international travel. And those individuals who cannot avoid travelling need to make sure that coronavirus is not excluded. Otherwise, buying a travel insurance policy would make no financial intelligence.

Final Words

Coronavirus may affect anyone, you can’t predict it. Therefore, it’s always advisable to take preventive measures. On the other hand, you can cushion yourself against the coronavirus outbreak by purchasing a separate health insurance plan against coronavirus. The policy offers up to 2 Lakh Sum Insured for Rs. 299/*- for a year. Click here to buy the coronavirus insurance policy or to know more about the product.