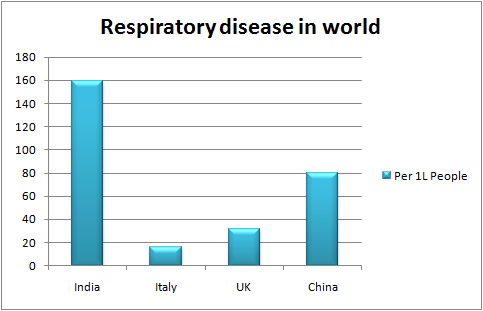

8 years old Ankit stays with his parents in New Delhi. Unlike his friends, he doesn't go out to play because he has respiratory problems. No, this is not an in-born complication. The issue developed as he has grown up over the years. And, Ankit is now happy to stay indoors as he doesn't have to breathe the toxic Delhi air. Air pollution happens to be the fifth leading cause behind death in India. A staggering 620,000 premature deaths take place in India each year. Innocent boys and girls of Ankit's and even of lower age fall prey by various deadly diseases triggered by air pollution like stroke, (COPD), ischemic heart disease, chronic obstructive pulmonary disease, lower respiratory infections and lung cancer among others. India’s National Health Profile 2015 said, number of acute respiratory infection cases reached a whopping 3.5 million in 2014. The rate at which respiratory diseases are increasing is alarming to say the least. As the total reported cases has risen by 140,000 compared to the previous year. India Tops the World in Respiratory Ailments Rate of respiratory disease related death in India is the highest in the world. In India 159 such cases occurred in 2012 in per 100,000 people.  Is Only Delhi's Climate Worsening or is the Entire India at Stake? Delhi is not alone when it comes to air pollution. As many as 41 Indian cities have been identified by Central Pollution Control Board with poor air quality. However, air pollution is not the only form of pollution in India and the sole reason behind increasing ailments. Water pollution quite evidently is its partner in crime because the recent survey says around 37.7 million Indians fall sick due to waterborne diseases every year. Isn't is shocking that about 1.5 million children in India die due to diarrhea alone? Too Many Diseases, Too High Medical Expenses All these types of pollution and the diseases that they bring with have been putting people in severe monetary trouble for treatment and getting cured. Yes, standard of treatment in India has risen a lot over the years and with it the cost of treatment also increased at a breakneck speed. In metro cities like New Delhi, private hospitalization costs like gold. Apart from hospitalization, even doctor's visit and OPD expenses are not negligible as well. Since, income is limited and economic recession is looming large medical expenses are becoming too high to manage. Health insurance in India is, therefore, the need of the hour. What Type of Health Insurance Should One Opt for? When it comes to pollution-related ailments, most people resort to OPD care as these diseases can be cured without hospitalization. In India's health insurance realm, OPD care used to be ignored, however, now there are quite a few health insurance plans in India that provide good coverage for OPD expenses and other medical expenses that don't require hospitalization. Let's take a look at some of the best health insurance plans in India with OPD coverage. Top Health Insurance Plans with OPD Coverage in India

Is Only Delhi's Climate Worsening or is the Entire India at Stake? Delhi is not alone when it comes to air pollution. As many as 41 Indian cities have been identified by Central Pollution Control Board with poor air quality. However, air pollution is not the only form of pollution in India and the sole reason behind increasing ailments. Water pollution quite evidently is its partner in crime because the recent survey says around 37.7 million Indians fall sick due to waterborne diseases every year. Isn't is shocking that about 1.5 million children in India die due to diarrhea alone? Too Many Diseases, Too High Medical Expenses All these types of pollution and the diseases that they bring with have been putting people in severe monetary trouble for treatment and getting cured. Yes, standard of treatment in India has risen a lot over the years and with it the cost of treatment also increased at a breakneck speed. In metro cities like New Delhi, private hospitalization costs like gold. Apart from hospitalization, even doctor's visit and OPD expenses are not negligible as well. Since, income is limited and economic recession is looming large medical expenses are becoming too high to manage. Health insurance in India is, therefore, the need of the hour. What Type of Health Insurance Should One Opt for? When it comes to pollution-related ailments, most people resort to OPD care as these diseases can be cured without hospitalization. In India's health insurance realm, OPD care used to be ignored, however, now there are quite a few health insurance plans in India that provide good coverage for OPD expenses and other medical expenses that don't require hospitalization. Let's take a look at some of the best health insurance plans in India with OPD coverage. Top Health Insurance Plans with OPD Coverage in India

|

Name of the plan |

Provider of the plan |

Coverage |

Special Features |

Downsides |

| Health Advantage Plus | ICICI Lombard | Diagnostic tests, consultation fees for Physicians, cost of medicines, General Practitioners, Pediatrician. Gynecologist, | OPD coverage is available from first day of the policy, availability of maternity benefit | Only one claim during one policy year to cover OPD expenses |

| Maxima | Apollo Munich | Dental procedures and treatment, cost of contact lenses and other eyewear, hearing aids, doctor’s consultation, pharmacy expenses, cost incurred for diagnostic tests, health check-up | Cashless facility available from authorized pharmacies, diagnostic centers, dental and optical care centers. Maternity benefits before and after childbirth, 50% Out Patient treatment coverage is carried forward if not used | Minimum and the maximum age for entry are 91 days and 65 years respectively |

| Cigna TTK | ProHealth Accumulate Plan | Outpatient treatment, dental treatment, optical care, consultation fees, pharmacy bills | Personal Health Wallet” to keep funds and to pay for OPD expenses. The money accumulated in wallet gets carried forward if not used. 5% hike available on the money accumulated in the wallet |

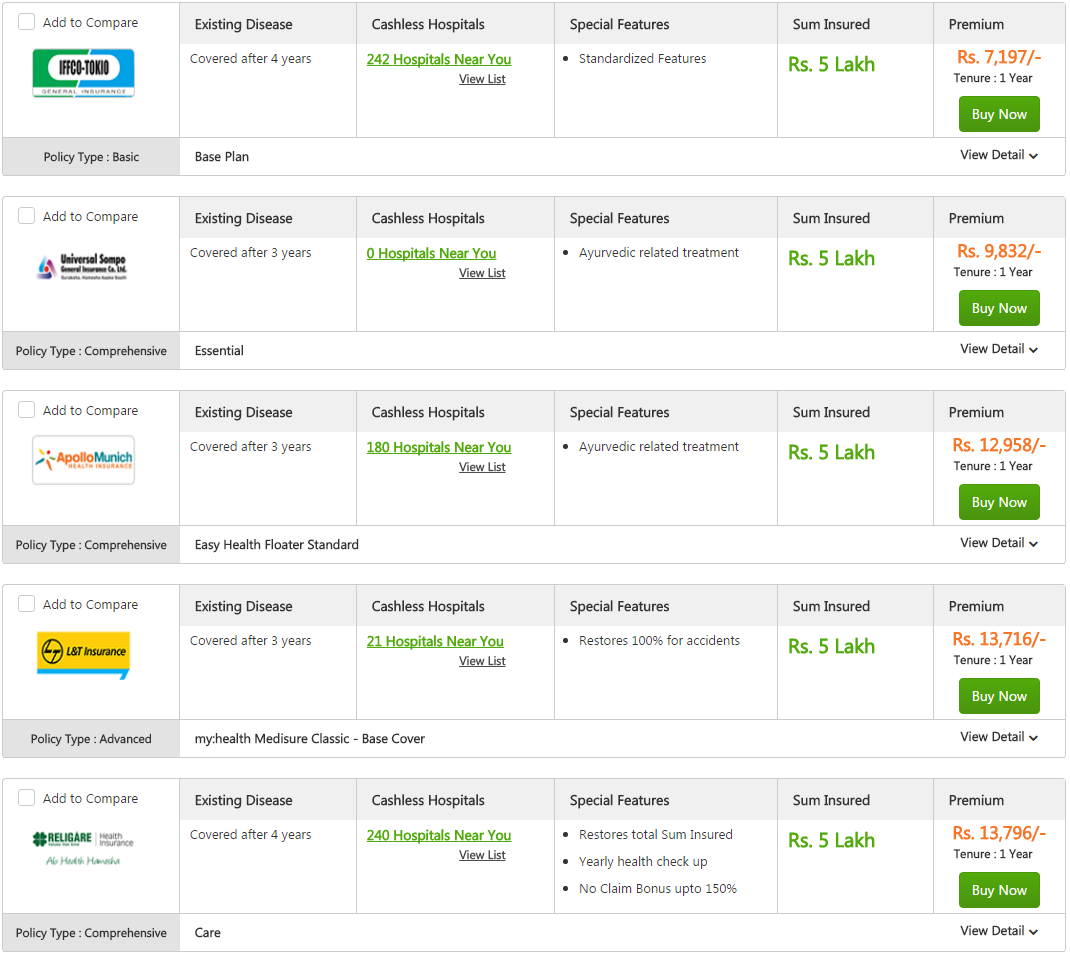

Out of these 3 health insurance plans with OPD coverage, the Cigna TTK ProHealth Accumulate Plan is the standout. It has no downside and comes with an array of beneficial features for policyholders. But It Doesn't Always Suffice! Severity of ailments and frequency of incidence of falling sick to these diseases have gone up. Many diseases now require hospitalization, that needed just OPD care earlier. This why Indian people especially those who stay with children and elderly parents should avail a family health insurance plan. Children and senior people are more vulnerable to pollution-related diseases as their lack of resistance power tend to aggravate their complication. 5 Top Family Health Insurance Plans in India Here is a list of best health insurance plans in India for a family consisting of a couple with two children living in the most polluted city in India, Delhi. The husband and his spouse are 32 and 30 years old respectively and their two children are 8 and 5 years old respectively. The chosen coverage is Rs. 5 Lakhs because the family lives in a metro city where cost of treatment is high and the total Sum Insured is supposed to be shared among all family members.  Source: GIBL.IN The lowest available health insurance premium is Rs.7197. However, you shouldn't just compare health insurance online on the basis of premium as you have to keep other vital parameters to choose the best health insurance in India in mind as well. You have to check the following aspects of health insurance plans as well as of the health insurance companies in India.

Source: GIBL.IN The lowest available health insurance premium is Rs.7197. However, you shouldn't just compare health insurance online on the basis of premium as you have to keep other vital parameters to choose the best health insurance in India in mind as well. You have to check the following aspects of health insurance plans as well as of the health insurance companies in India.

- Range of network hospital

- Renewability

- Sub limits on various expenses

- Co-pay

- Waiting period on pre-existing conditions

- Coverage on various conditions asode from usual hospitalization such as maternity, critical illness

- Benefits on offer such as Sum Insured restore benefit

There is, however, no such health insurance policy that excels in all aspects and still meets everyone's budget. You, therefore, have to find an acceptable trade off between your requirements, budget and available health insurance plans for your family. And, once you find such a plan you shouldn't be bothered by premium even if it is a bit high. The financial protection you will get in return will be lot many times higher than what you could have saved by buying health insurance that fails to meet majority of your requirements. Why Should You Buy Health Insurance Online Now? As long as you are hale and hearty your risk to health insurance companies would be less and hence premium would be lower. But once you catch any disease such as asthma your health insurance premium will go up by at least 10 to 20%. And, this holds truer for older people as their chance of recovery is less and falling sick is more. This is why it is sensible to have one when you and your family members are in the pink of health. Most health insurance plans in India come with waiting period. Being fit, you won't have the urgency to make any claim during waiting period. With the increasing popularity of online insurance plans, it is now effortless to buy health insurance online. GIBL.IN is India's premiere online insurance marketplace where you can search, compare, buy and renew health insurance online. You can also manage your health insurance online policy on the go by using the GIBL mobile app. You cannot do much about growing pollution-related diseases no matter how conscious you personally are, all you can do is stay protected financially. You cannot ensure that you will remain immune to all diseases, but you can ensure that your bank balance will remain intact even after expensive treatments of ailments you couldn't evade. 10% of all 300 million asthmatics patients across the world live in India. Buy health insurance online today before its late and enjoy a worry-free life.