Rahim Sheikh is a poor Indian peasant who had sold his only asset, a tiny slice of land in order to treat his son who was suffering from Leukemia. Unfortunately, neither he could save his son nor he could get his land back ever after.

Anand Goel is a middle class salaried Indian who had sold his car to arrange money in a haste. His father had a cerebral attack and had to be operated immediately.

Apparently, Rahim Sheikh and Anand Goel are worlds apart when it comes to lifestyle, financial stability and the likes. But, one thing they had in common; they both fell pray to monstrous out-of-pocket medical expenses which forced them to sell their assets.

Increasing number of incidences of Catastrophic Healthcare Expenditure (CHE) is sharply contributing to poverty. Health care costs are impoverishing and even public hospitalizations result into CHE. More than 63 million people in India are bracing impoverishment every year only because of medical expenses.

Why do Indian people face enormous difficulty while coping up with medical expenses? Most simply put, advent of sophisticated diagnosis and treatment triggers the cost and the Government provides very little for Public Health Expenditure.

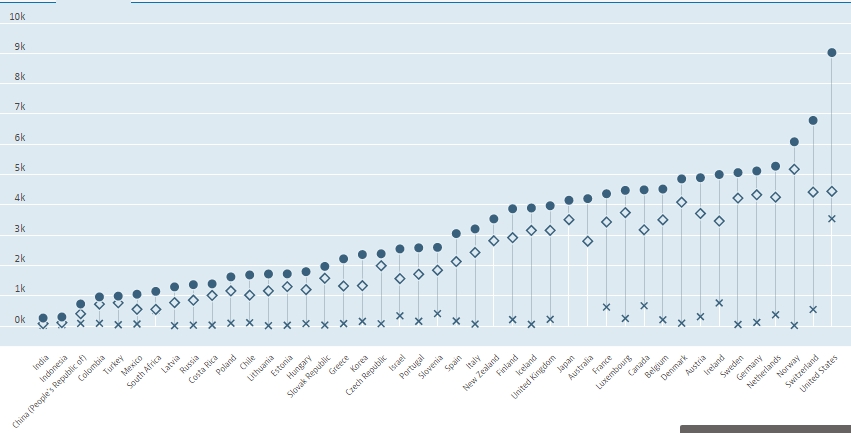

In 2014, India's total health expenditure per capita was US$ 267.4. The Union budget 2016-17 increased total public spending to a mere 1.87% much lower than the proposed 2% - 3% of the GDP.

So is there any respite for common Indians? Is there at all any way to battle the demon of high-cost treatments out?

Health insurance in India is no longer a strange concept. Many Indians have long been familiar with mediclaim and the facilities associated with it. Health insurance is is the new and improved version of those plans and thanks to widespread usage of Internet, now one can buy health insurance online in India. It is indeed a great way to curb out-of-pocket health care expenses.

Of late, India's online insurance market boasts scores of online health insurance plans. The trick lies in finding the best health insurance without burning a whole in the pocket. Cheap health insurance policies are available aplenty so the key is to compare health insurance covers and avail the one that meets all ends.

Finding The Cheapest Health Insurance

The first and foremost thing is to decide for whom the policy is being taken. It can be for an individual or for families. Families can also be divided in several different types on the basis of number of members, age of the members etc. Here is a list of family types;

- Newly Married couple( Husband 30 years and wife 28 years)

- Young family with kids (Husband 32 years, wife 30 years, two children below 10 years)

- Older family with children (Husband 50 years, wife 45 years, two kids 21 and 19 years, parents 72 years and 68 years)

Let's start with the cheapest health insurance for individuals.

Here is a list of cheapest health insurance that individual person can avail.

3 Cheapest Individual Health Insurance Plans in India

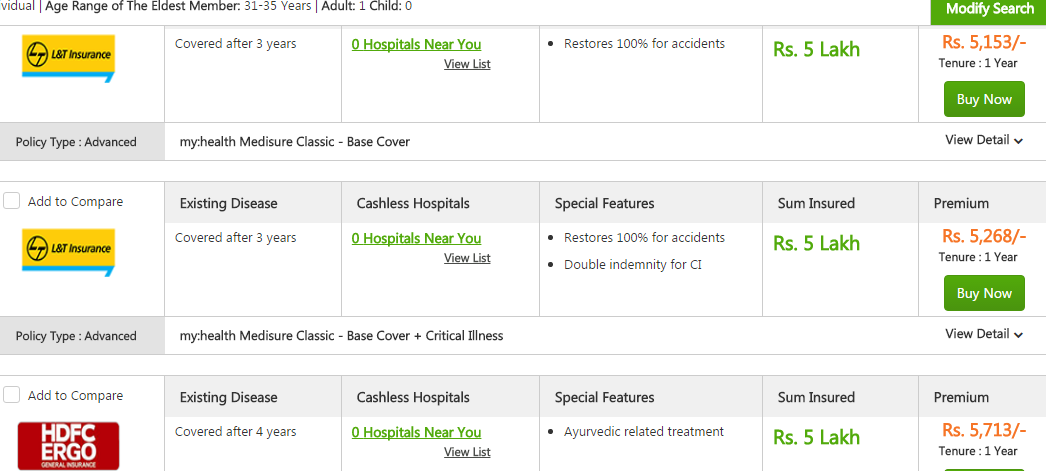

The following list of health insurance policies in India are cheapest for an individual in the age-group of 31-35 years living in Mumbai. The chosen Sum Insured is Rs. 5Lakhs.

Source: GIBL.IN

The premium of the cheapest health insurance for an individual is provided by L & T Insurance at Rs. 5153. This means a person in the age-group of 31-35 years living in Mumbai has to spend less than Rs. 430 per month to get a coverage of Rs. 5 Lakh. Sounds really cheap!

Let's find out the cheapest health insurance for various family types.

3 Cheapest Family Health Insurance Plans in India

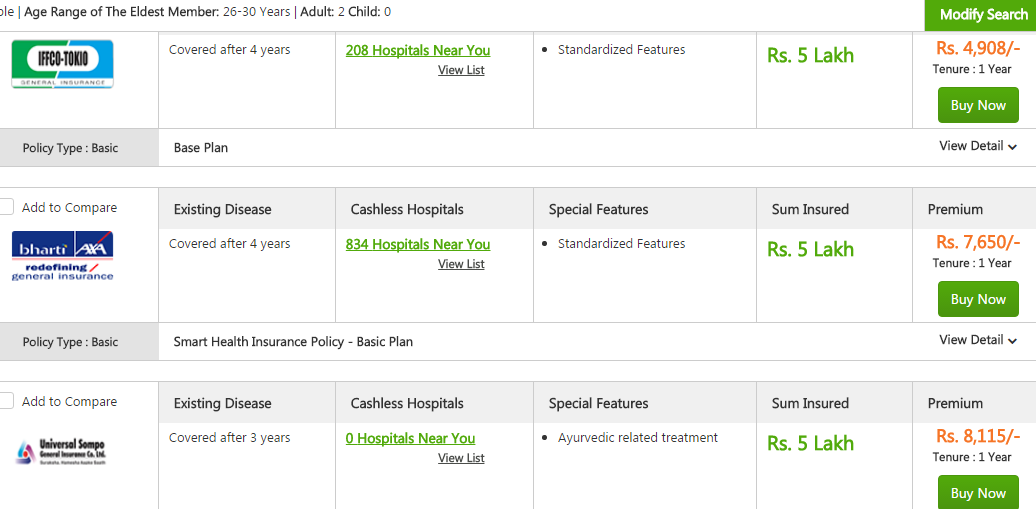

First list consists of cheapest health insurance for newly married couple( Husband 30 years and wife 28 years) living in Mumbai. The chosen Sum Insured is Rs. 5 Lakhs. .

Source: GIBL.IN

The premium of the cheapest health insurance for a couple is provided by IIFCO Tokio at Rs. 4908. The couple living in Mumbai has to spend just over Rs. 400 per month to get a coverage of Rs. 5 Lakh. This is even cheaper!

3 Cheapest Health Insurance for Young Family with Kids

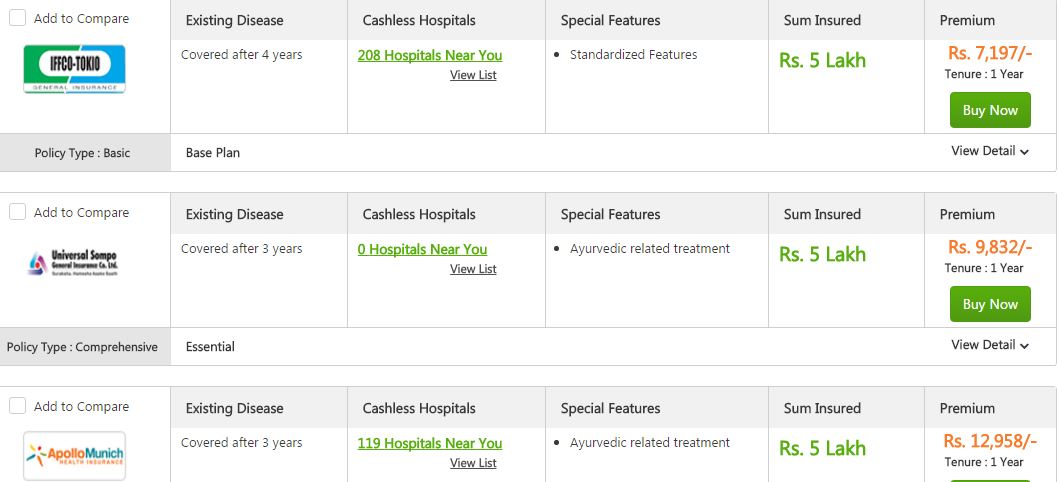

Second list consists of cheapest health insurance for young family with kids (Husband 32 years, wife 30 years, two children below 10 years). The chosen Sum Insured is Rs. 5 Lakhs.

Source: GIBL.IN

The premium of the cheapest health insurance for young family with kids is provided by IIFCO Tokio at Rs. 7197. The couple has to spend less than Rs. 600 per month to get a coverage of Rs. 5 Lakh for the entire family.

3 Cheapest Health Insurance for Older Family with Grown-Up Children

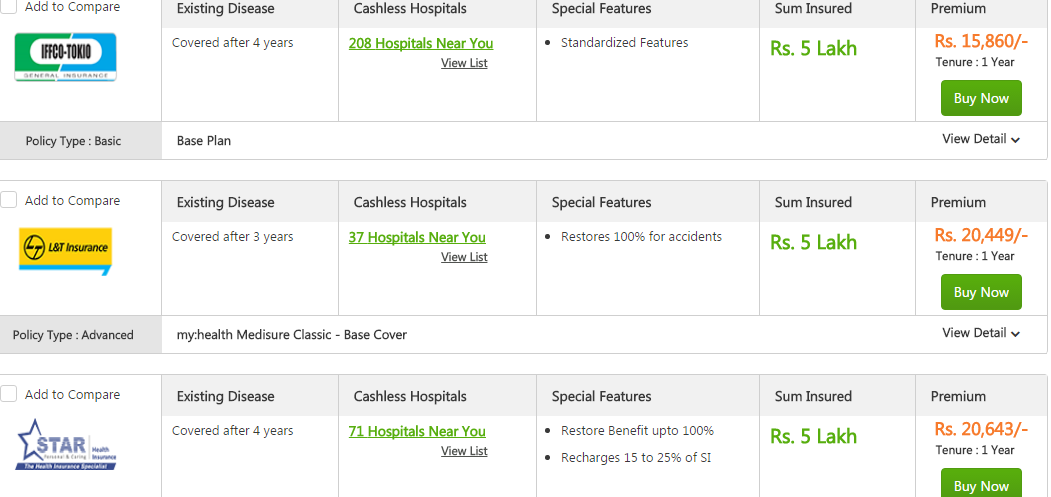

Third list consists of cheapest health insurance for older family with grown-up children (Husband 50 years, wife 45 years, two kids 21 and 19 years). The chosen Sum Insured is Rs. 5 Lakhs.

Source: GIBL.IN

The premium of the cheapest health insurance for older family with grown-up children is provided by IIFCO Tokio at Rs. 15,860. The couple has to spend around Rs. 1321 per month to get a coverage of Rs. 5 Lakh for the entire family.

Why Should You Avail Cheap Health Insurance in India?

With constant inflation in health care expenses, common people in India find their savings to suffice to safeguard their financial burden. Cheap health insurance online comes with a myriad of beneficial features and goes a long way in helping people have access to quality treatments without being indebted.

3 Things to Look for in A Cheap Health Insurance Plan Online

There are many aspects of a health insurance like network hospital, cashless facility, co-pay option that you have to check out closely. However, the most vital facets are discussed here below.

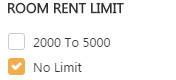

Understand The Room Rent Limit -

This is the most crucial factor for those who want to buy cheap health insurance online. The type of room chosen in the hospital determine the entire expenditure. This simply means that the same treatment, surgery, medicine costs less if the policyholder chooses a basic room.

Many people are under the misconception that room rent influences that expenditure only. Hence, they decide to opt for a room with higher rent than the limit prescribed in their cheap health insurance policy and think that they can pay the difference in room rent from their pocket. But, the choice of room with higher rent triggers the entire expense and in the end policyholders find it really hard the pay the difference in total bill as their insurers pays partially, only according to the room rent limit imposed by them.

|

Hospital Bill |

Insurer's Liability |

Payable Amount Explained |

|

|

Days of Hospitalization |

7 days |

||

|

Room Charge |

Rs. 42,000 |

Rs. 21,000 |

As per limit 3000 per day X 7 Days |

|

Doctor's fees |

Rs. 6000 |

Rs. 3000 |

Deducted Proportionately |

|

Medical Tests |

Rs. 4000 |

Rs. 2000 |

Deducted proportionately |

|

Surgery fees |

Rs. 80,000 |

Rs. 40,000 |

Deducted proportionately |

|

Cost of medicine |

Rs. 10,000 |

Rs. 10,000 |

MRP products |

|

Total |

Rs. 1,42,000 |

Rs. 76,000 |

If the room rent limit is Rs. 3000 per day and you choose a room of Rs. 6000 rent per day, all charges would be reduced proportionately at the time of claim payout except for MRP products.

Despite of having a coverage of Rs. 5 Lakhs you will get only Rs. 76000 paid out of the total Rs. 1,42,000, just because the rent of your chosen hospital room was beyond the stipulated limit.

Source: GIBL.IN

The best solution is to either choose a room within the prescribed limit or go for a cheap health insurance plan online that doesn't come with room rent limit. On the portal of GIBL.IN you can opt out the room rent limit and compare cheap health insurance policies without any restriction on room rent.

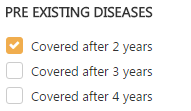

Look for least waiting period for pre-existing diseases

Maximum health insurance claims rejection is caused by this factor. All health insurance plans in India impose a strict waiting period before covering ailments that policyholders have been suffering from before applying for the policy.

Source: GIBL.IN

The waiting period ranges between 2 to 4 years. You need to look for cheap health insurance plans with the minimum 2 years of restriction as the sooner your diseases get covered less would be your out-of-pocket medical expenses.

Check Out The Claim Settlement Record

A cheap health insurance plan with minimum waiting period and no limit on room rent will be of new use if you don't get your claim approved in case of an emergency. This is why it is very crucial that you go through the the speed and ratio of claim settlement of health insurance companies in India. Typically, insurers that settle claim in less than 30 days and have a over 80% ratio are good to rely upon. f

Conclusions:

According to the reports of the National Sample Survey Office, the health care expenses has witnessed an upsurge of 6.9% from 6.6% in rural areas and 5.5% from 5.2% in urban India between the year 2004-05 and 2011-2012. Health Research Institute of PWC estimated that health care costs have risen from 6.5% in 2014 to 6.8% in 2015.

Being armed with a cheap health insurance in India is your best bet to shield your pocket from ever-increasing health care expenses. Cheap health insurance online is easily available and GIBL.IN facilitates informed decision making through seamless and fast comparison health insurance policy online. Get the cheapest health insurance in India and ease your financial burden now.